Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Economic and Investment News Bits

- Longest Bull Market (almost): The S&P 500 is poised to become the longest bull market on August 22, 2018 (3,453 days) surpassing the previous record-holding bull run (October 11, 1990 – March 24, 2000, 3.452 days, or 9.5 years). (Source: MarketWatch)

- Happy Birthday, Social Security!: President Franklin D. Roosevelt signed the Social Security Act into law 83 years ago. Currently, 62 million Americans (19% of the U.S. Population) receive a monthly benefit payment that averages $1,343. Approximately 1 in 5 seniors rely on Social Security for virtually all of their income. (Source: The Center on Budget and Policy Priorities)

- Parental Support: Young adults (ages 25-35) with children see faster earnings recoveries after job loss when they live closer to their parents. Theories include assistance with child care, job searching, and moral support. American parents on average spend $233,610 on raising children between birth and age 17 for housing, food, babysitting, and transportation costs…and not including college. (Source: Federal Reserve Bank of Cleveland)

- Dumbing Ourselves Down: IQ scores have been steadily falling for the past few decades. Research suggests this is not due to genes but may instead be due to environmental factors including changes in the education system and media environment, nutrition, reading less, and being online more. (Source: CNN)

- Life Expectancy Declining: Life expectancy in the U.S. has declined for 2 years in a row (the first time since the 1960s), albeit modestly (from 78.9 to 78.6). The primary reason for this is a surge in fatal opioid overdoses and a plateau in the reduction of deaths from heart disease. The last time the U.S. life expectancy dropped was in 1993 due to the AIDS epidemic. (Source: National Center for Health Statistics)

Thought for the Month

“Children want the same things we want. To laugh, to be challenged, to be entertained and delighted.”

– Theodor Geisel (aka. “Dr. Suess”), American author (1904-1991)

Commentary – Safeguarding Your Home

One in every thirty-six homes in the United States is burglarized each year resulting in an average loss of $2,230 per break-in. 65% of home burglaries happen between 6am and 6pm while residents are at work or running errands, with burglars often posing as a sales or delivery person to see if anyone is home. 25% of homeowners frequently leave the front door unlocked, aiding the 34% of burglars who enter through the front door. Master bedrooms are the most common room for a burglar to target because of items like jewelry, collectibles, and safes. The average time a burglar spends in a home is 10 minutes. Tips to make your home more secure include locking your windows and doors (particularly deadbolts), trimming shrubbery for better visibility from any passerby, and technological deterrents including alarm systems and security cameras. Many insurance companies provide a discount on homeowner’s insurance for a monitored alarm system. Also, people who advertise they are not home by posting to social media (i.e. vacation pictures) are more likely to be targets.

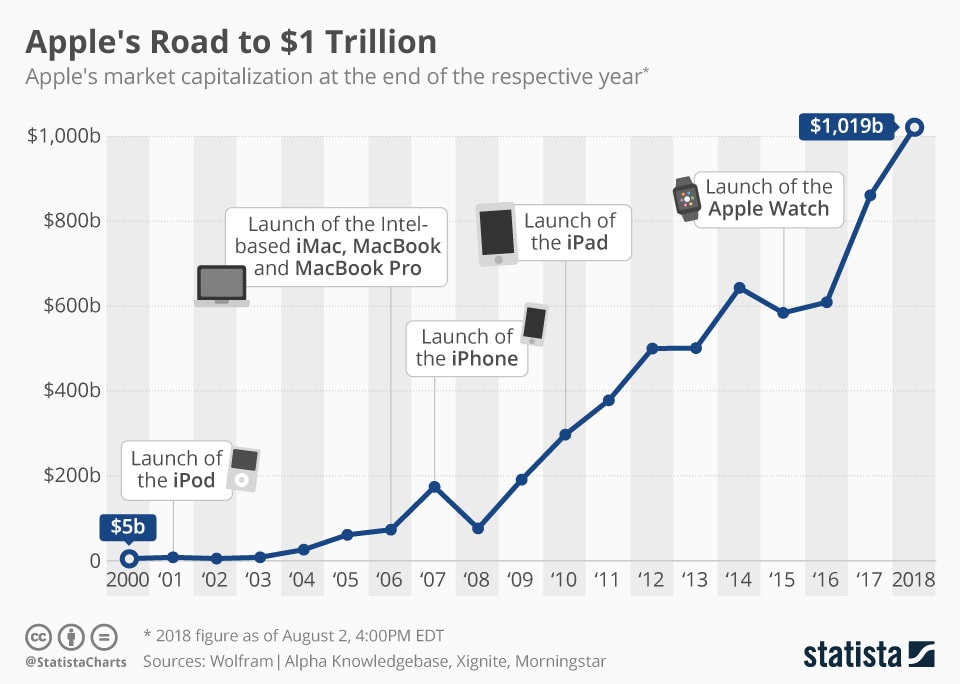

Chart for the Month – Apple’s $1 Trillion Value

Apple became the first company to reach $1 trillion (12 zeroes) in market value earlier this month. This chart shows their ascent from a $5 billion market value in 2000 to today, with important product releases along the way. The ubiquitous iPhone was released just 10 years ago in 2008 and has sold 1.4 billion phones. Particularly impressive is that this company founded in a garage in 1976 was just 90 days away from declaring bankruptcy in 1997.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.