Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

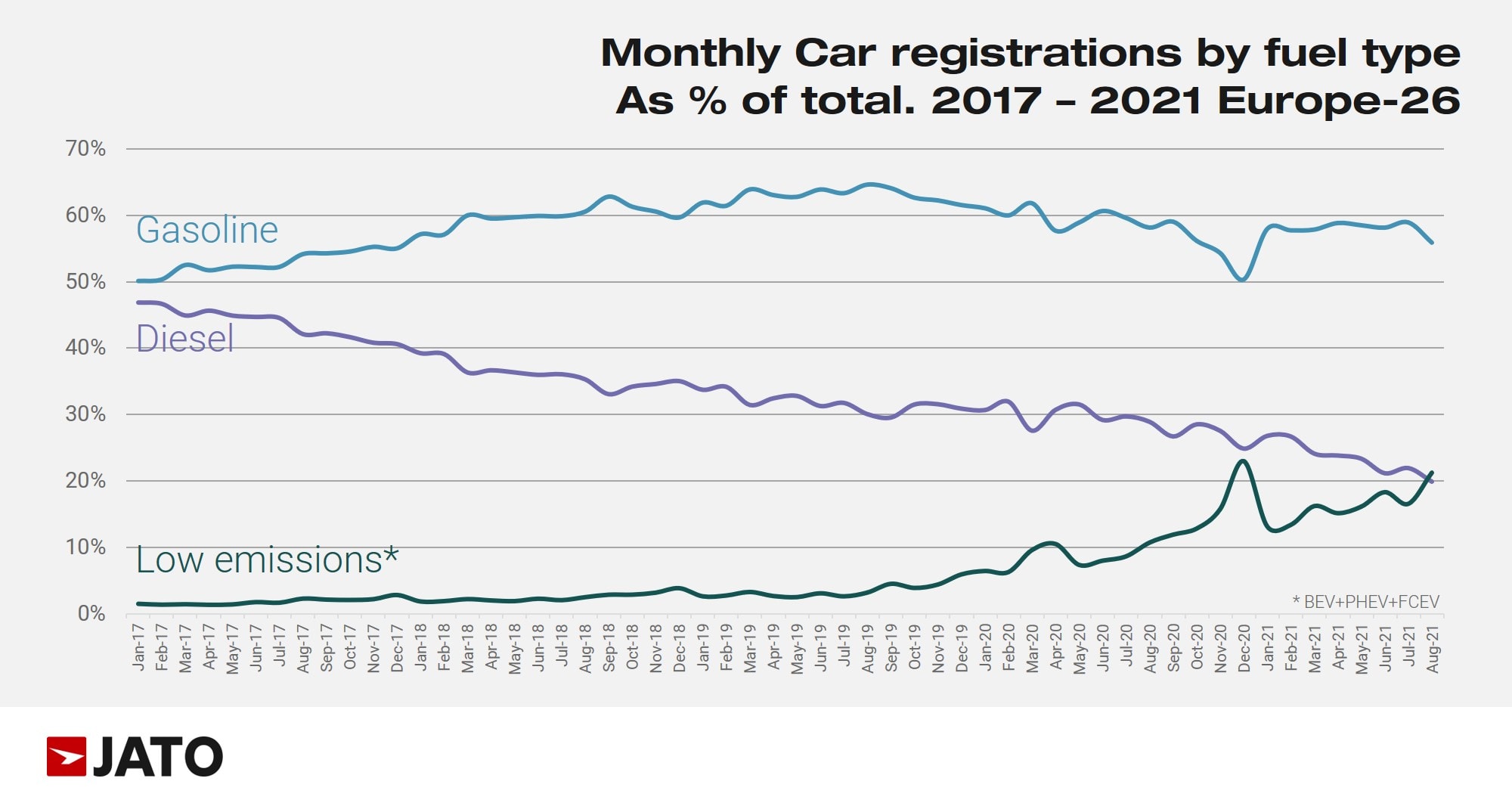

- EVs Outsell Diesel: For the first time ever, European electric vehicles and plug-in hybrids outsold their diesel counterparts in August. In fact, EVs and hybrids were the only type to show any increase in growth in terms of market share, outlining a fundamental shift in buying habits in Europe. (Source: JATO)

- Molnupiravir: Merck and Ridgeback developed what’s being called the Covid pill. The company states the “drug can halve rates of hospitalization among people recently diagnose with mild or moderate Covid-19.” It has yet to be cleared by the FDA and is expected to become available in early 2022. It’s most effective when taken within 5 days of getting sick, a very tight window. The drugs is named after Thor’s hammer, Mjölnir. (Source: The Atlantic)

- A Million Reasons: The Ronald McDonald House of Columbus recently started a campaign to expand its current campus. Their project goals include, adding 80 rooms to accommodate more families and expanding the kitchen and dining area while adding new community rooms to create more space for the expected 2,000 more families per year! (Source: NBC4 Columbus)

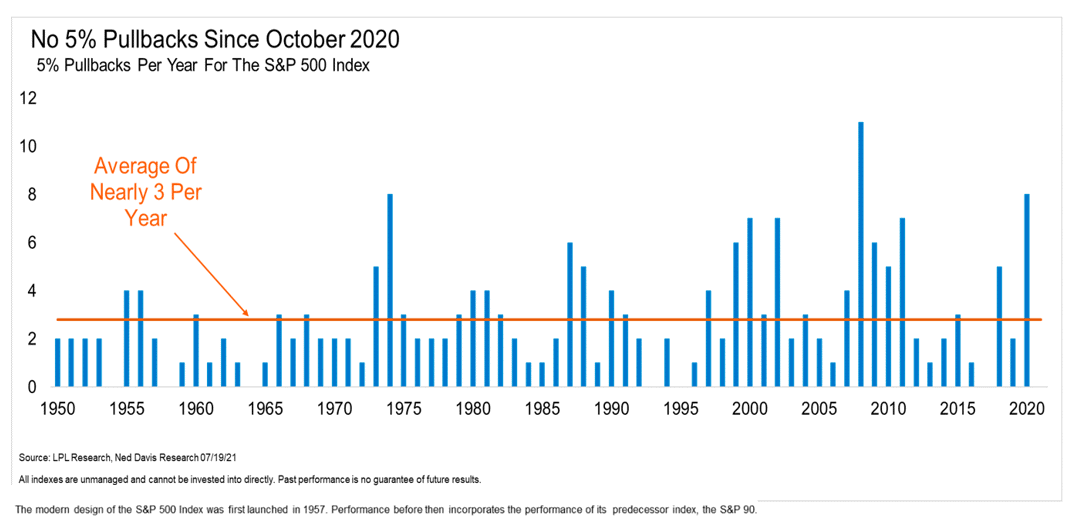

- First Pullback of 5%: After nearly 1 calendar year of modest volatility, the S&P 500 (the market) experienced a drop of at least 5% or more. From September 2nd through October 4th, the S&P 500 fell 5.2% before cutting the loss in half through the next three trading days. For more information, see below.

More on Pullbacks

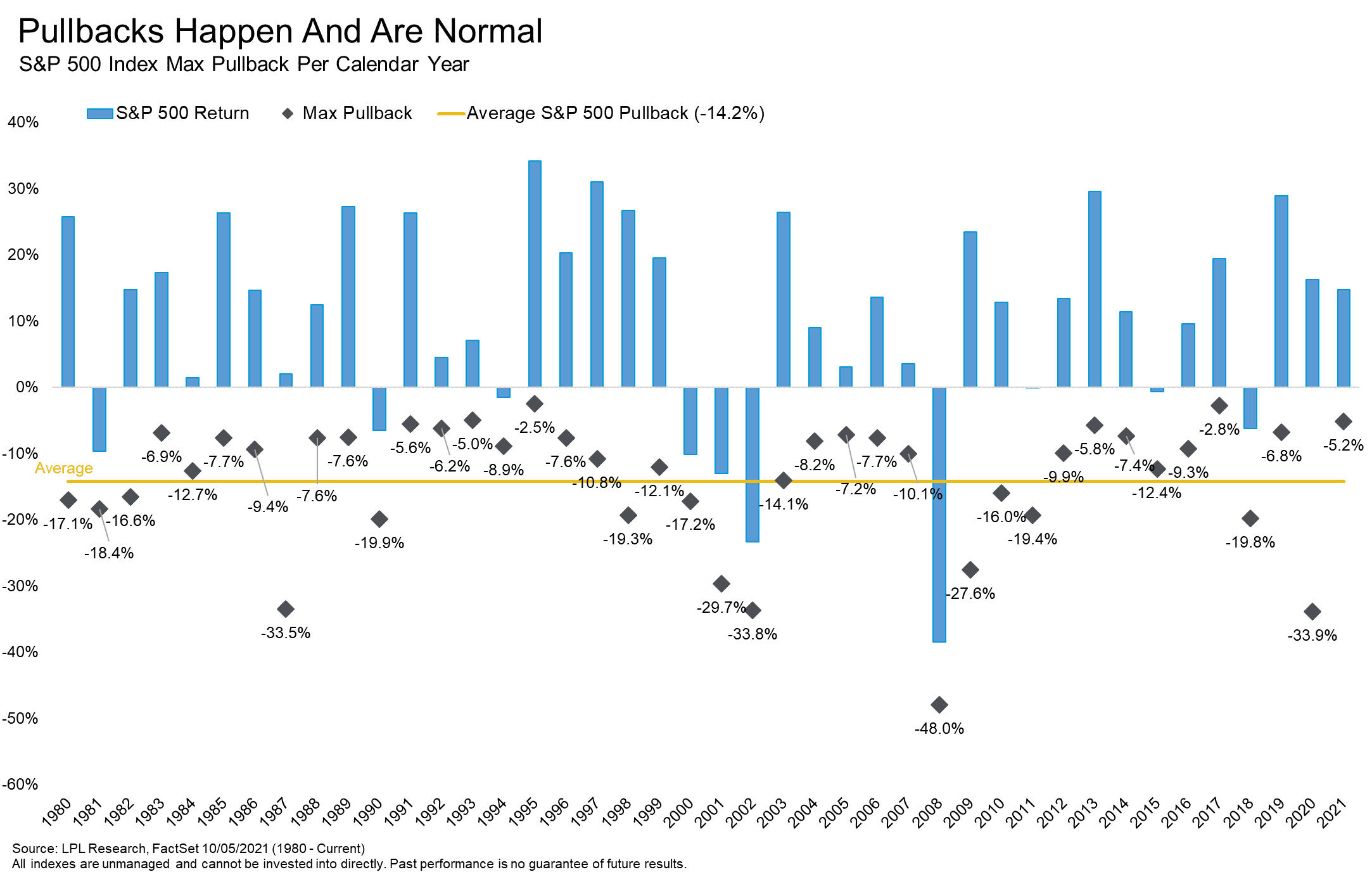

Despite what the last 12 months has shown in the stock market, volatility it normal. If this sounds repetitive, it’s because it is. We have written about and discussed volatility a number of times, but a refresher on the topic can sometimes help settle emotions and quell any market fears.

As mentioned above, the market experienced the first 5% loss in the last nearly 12 months. It’s never fun to watch the market drop as precipitously as it did, but again, volatility is normal. LPL Research found the S&P 500 pulls back 5% an average of 3 times per year, dating back to 1950.

To put this recent 5% into perspective, they go on to find average pullback in the S&P 500 going back to 1980 is -14.2%. It’s important to remember, even during years of outsized gains, the market is still liable and likely to experience a significant bout of volatility.

To review our past blog posts on volatility in the stock market, see the links below!

- Volatility

- Historical Stock Market Returns

- Market Predictions

- Irrational Exuberance

- Behavioral Finance: Gambling on Stocks

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.