April 2022 PDS Market Commentary

“There is no shortage of headwinds facing both the market and the economy: the tragic Russian invasion of Ukraine and attendant commodity/energy crisis; the Federal Reserve’s transition from accommodative to tighter monetary policy; and increased chatter of a recession on the horizon; among others,” according to Schwab’s Liz Ann Sonders. Despite all of these headwinds, markets ended the month with a significant rally to offset a good portion of the year-to-date losses.

But many investors are asking why are stocks rallying in this environment? Caitlin McCabe and Gunjan Banerji from the Wall Street Journal recently released a few potential reasons for this recent rebound:

- History suggests stocks have more room to run

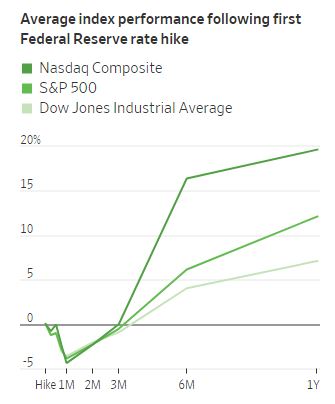

- One of the reasons for the recent volatility is the Federal Reserve’s stance to now continually increase interest rates and unwind the stimulus as a measure to fight inflation. However, markets have historically grown after the Fed starts raising interest rates. “In the five rate-hiking cycles since 1990, the S&P 500 tumbled a month after the first rate increase but typically recouped those gains to rally six months later.”

- One of the reasons for the recent volatility is the Federal Reserve’s stance to now continually increase interest rates and unwind the stimulus as a measure to fight inflation. However, markets have historically grown after the Fed starts raising interest rates. “In the five rate-hiking cycles since 1990, the S&P 500 tumbled a month after the first rate increase but typically recouped those gains to rally six months later.”

- The economy is still strong

- “U.S. job growth remains strong, with the March report showing employers added 431,000 jobs, the 11th straight month with an increase of more than 400,000. That marked the longest streak in records dating back to 1939.”

- Real yields are still negative

- Real yields are the net interest earned from government bonds after accounting for inflation. These continue to be negative which forces many investors to shift to stocks in attempt to earn positive real returns above inflation.

- Bets of corporate resiliency

- Earnings season is kicking off and most economists are expecting many companies to be able to navigate record inflation by raising prices. The bump in wage growth has allowed the demand to remain strong, despite the inflation.

Markets will continue to face an increased amount of volatility in the months ahead as they deal with these headwinds. We remind investors to take a long-term diversified approach, and not to get caught up in the recent weekly or monthly swings in and out of favor.

| Asset Index Category |

Category |

Category |

5-Year |

10-Year |

|

3-Months |

1-Year |

Average |

Average |

|

| S&P 500 Index – Large Companies |

-4.9% |

14.0% |

13.9% |

12.4% |

| S&P 400 Index – Mid-Size Companies |

-5.2% |

3.2% |

9.4% |

10.5% |

| Russell 2000 Index – Small Companies |

-7.8% |

-6.8% |

8.4% |

9.5% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) |

-5.5% |

6.2% |

11.3% |

10.0% |

| MSCI EAFE Index – Developed Intl. |

-5.9% |

1.2% |

6.7% |

6.5% |

| MSCI EM Index – Emerging Markets |

-7.0% |

-11.4% |

6.0% |

3.3% |

| Short-Term Corporate Bonds |

-2.9% |

-2.7% |

1.6% |

1.4% |

| Multi-Sector Bonds |

-5.9% |

-4.1% |

2.1% |

1.9% |

| International Government Bonds |

-7.2% |

-10.0% |

-0.2% |

-1.7% |

| Bloomberg Commodity Index |

25.5% |

49.2% |

9.0% |

-0.4% |

| Dow Jones U.S. Real Estate |

-6.5% |

20.1% |

10.1% |

10.2% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.