Welcome to our August 2023 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Corporate Earnings Season

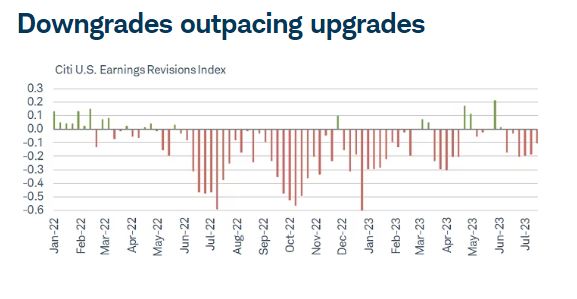

Nvidia, one of the last of significance, reported earnings after the market closed yesterday. To the joy of all following the AI hype train, they exceeded expectations and expect success to continue. But a successful earnings report this quarter isn’t the norm. As of the end of July, the ratio of analyst earning per share [EPS] revisions have been negative. Meaning, analysts are expecting things to get worse before they get better. After a booming first half of 2021, S&P 500 companies’ earnings growth has slowed in consecutive quarters with the expectation that 2023 is an uphill battle.

Mortgage Rates Stink

The interest rate on 30 year fixed mortgages continues to rise to the dismay of many hopeful first-time homeowners. Two years ago, the average rate was 2.80%. Now, it’s up near 7.50%. In the same amount of time, the median home price has risen to over $400,000, a 25% increase, putting another major hurdle in front of potential buyers.

- A 30 year fixed rate 2.8% mortgage on a $320,000 loan (20% down on a $400,000 home value) results in approximately $1,300 monthly principal and interest payments bringing the total cost of the loan to $473,000 according to Bankrate mortgage calculator.

- A 30 year fixed rate 7.50% mortgage on a $320,000 loan (20% down on a $400,000 home value) results in approximately $2,200 monthly principal and interest payments bringing the total cost of the loan to $805,000 according to Bankrate mortgage calculator.

These are best case scenarios based on a ‘standard’ 20% down payment. Though, I don’t know a lot of younger people with $80,000 lying around. With less down and a larger loan, the numbers just inflate.

Cold Spell for China’s GDP

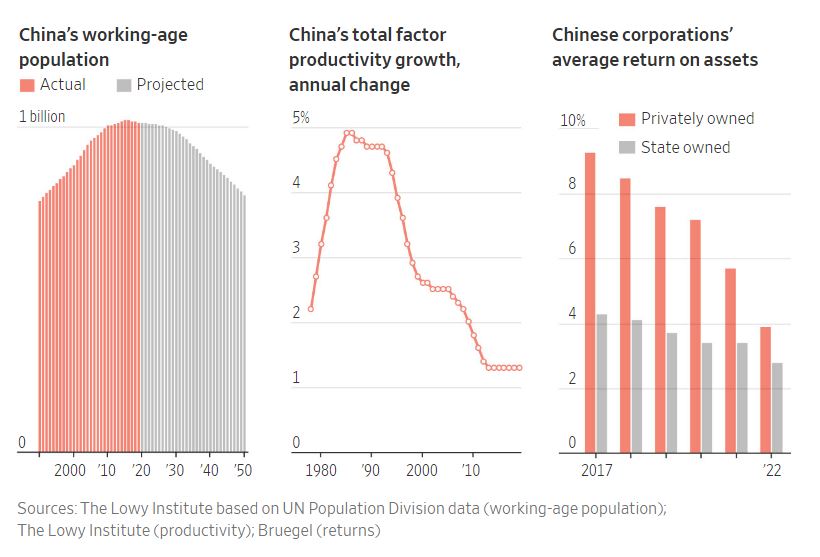

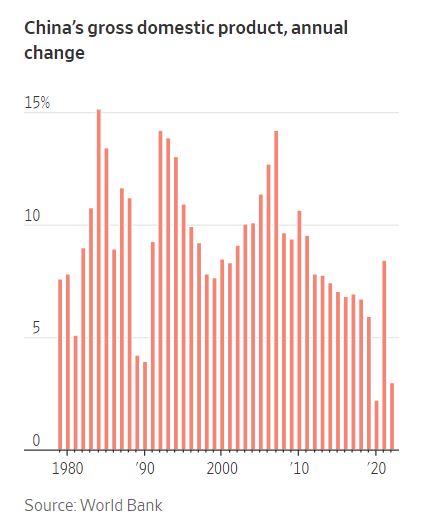

The Chinese economy has begun slowing dramatically, certainly exacerbated by the Covid-19 pandemic, but would be facing trouble even in the best of times. After over a decade of 7%+ year-over-year GDP growth, economists are modeling less than 4% in coming years. “Capital Economics, a London-based research firm, figures China’s trend growth has slowed to 3% from 5% in 2019, and will fall to around 2% in 2030”, reports Lingling Wei and Stella Yifan Xie at the Wall Street Journal. The long-term future is bleak as well. China’s population of working age individuals is estimated to shrink, productivity has remained stagnant, and their corporations return on assets is steadily shrinking. All while major real estate developers teeter on the edge of default.

Finally, Something to the Moon!

Days after a Russian probe crashed in the moon’s south pole, India celebrated success after landing its Chandryaan-3 spacecraft where no other country has before. Scientists hope the moon’s south pole can be tapped for water resources to “facilitate missions to other parts of the solar system and future efforts for long-term settlements on the moon.” It sounds like a line in the latest sci-fi book you’re reading (Andy Weir), but it’s real and a monumental achievement for India and the world.

No Matter Their Zip Code

The 2023-34 school year is officially underway in Columbus. After a lot of work last year and through the summer, 99% of schools are beginning the year with A/C, something that couldn’t be said at this time last year. But there are still improvements to be made. As such, the Columbus City school board unanimously approved the proposal for a property tax levy be put before voters this November. The levy would bring in nearly $100 million per year for the district to enhance teacher salary and generally improve schools and the students learning environments. Brandon Simmons, a recent Columbus City Schools grad, wrote in the Columbus Dispatch, “I dream of a Columbus where all of our kids are in the best classrooms money can buy. This levy is a golden opportunity to make that dream a reality. Imagine a Columbus where our children step into classrooms that inspire, challenge, and empower them. A Columbus where every student no matter their zip code has the chance to excel and thrive.”

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.