Welcome to our March 2024 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

By Drew Potosky, CFP®,

Posted: 3/20/2024

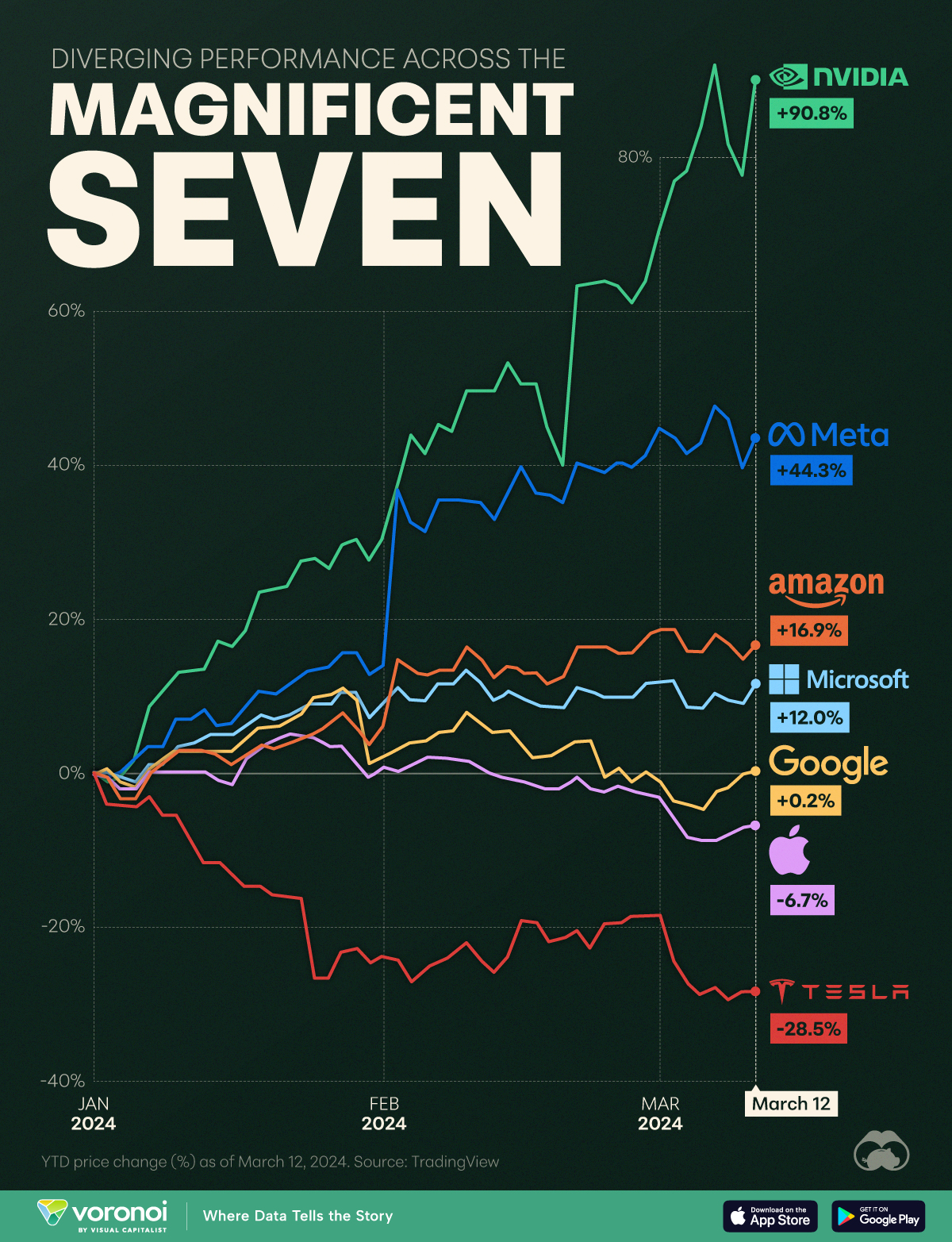

Mag 7 is so 2023

The now famed Mag7 stocks [MSFT, AAPL, NVDA, AMZN, META, GOOG/L, TSLA] tore through 2023, but 2024 has been a different story. Nvidia and Meta have continued their dominance and increased their size near the top of the S&P 500 index, but the other 5 companies have normalized. So much so that the magnificent 7 aren’t all that magnificent anymore. Only Nvidia and Meta have year-to-date returns that rank them in the top 10 among the S&P 500. Amazon, with the next best return, is 86th and Tesla brings up the rear with the worst return in the index. Despite the Mag7 disbanding, the index is still up nearly 9% in 2024, meaning the breadth of returns has grown outside just the largest holdings. But – it will take more than a few months for the performance of the top 10 to not mean as much. They still make up 33.7% of the index and thus have a greater impact on the overall return. (Source: Visual Capitalist)

THE RISE OF FINFLUENCERS *EMOTIONAL*

Did I pull you in with my fun YouTube clickbait title? No? Color me surprised. What may not have worked on you is working on a lot of younger people. And working enough to have the term ‘finfluencer’ coined. According to a paper published by the CFA institute and authors Serena Espeute and Rhodri Preece, CFA, (and my own experience scrolling through YouTube/TikTok/Instagram) “social media influencers are becoming a key vehicle to promote products and services, including in the financial services sector…They provide general investment information, promote investment products, offer guidance, and, in some instances, make investment recommendations.” While influencers are not a new thing, the promotion of investment products is and can be a slippery slope. Some people may not understand what they’re promoting or, on the other side, what they’re buying. (Source: CFA Institute)

- FINRA fined M1 Finance $850,000 as part of a settlement addressing alleged improper use of social media influencer program

- Network of Youtube financial influencers hit with class action suit for pumping up FTX

- Being a Financial Influencer Is Fun – Until You’re Fined!

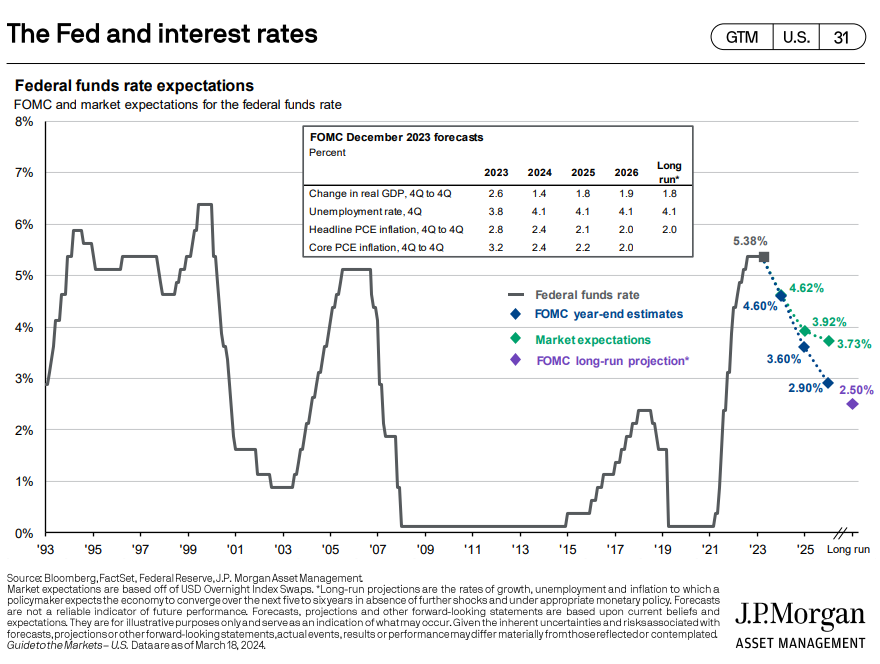

Update on Interest Rates

There has been no movement from the Fed on interest rates in 2024. This afternoon will be another rate decision from the Federal Open Market Committee and the expectation is, again, no change. The chart below is still anticipating interest rates being below 4% to start 2025, which means over 1% of rate cuts are still expected in the next 9 months. With rates remaining elevated above 5%, yields for cash will also remain strong. Consider a money market fund for any excess cash in bank accounts to potentially earn additional yield. For example, the Schwab Value Advantage Money Market has a current annual yield of 5.18%. (Source: JPMorgan)

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.