April 2020 Financial Markets Summary

The first quarter was a tale of two halves for both the markets and our daily lives. In the markets, the first month and a half started well with 2-5% gains across most asset classes. Investors’ biggest concerns seemed to be the trade tensions with China, slowing global growth, and escalating conflicts with Iran. But as coronavirus threats escalated, stock markets reacted at an unprecedented pace with the worst quarter since 2008. From February 19th through March 20th, the S&P 500 fell by -34% and the small cap index by -41%. International stocks didn’t fare any better with -34% losses.

Our daily lives have also changed dramatically. Most Americans were commuting to their daily job to start the year, while many are now attempting to work from home or are unfortunately no longer employed. Students are distance learning from home rather than being in the classroom, sporting events have been cancelled, social distancing rules are in place, and the list goes on and on.

We are almost certainly in the early stages of a global recession brought upon by this global pandemic and are merely waiting on the economic data to formalize the announcement. The near-term economic landscape is uncertain as the world endures the effects of COVID-19 on our health and daily lives. However, we are cautiously optimistic that globally coordinated responses addressing both the public health and economic impacts of the virus can help to avoid a deep, long-lasting recession.

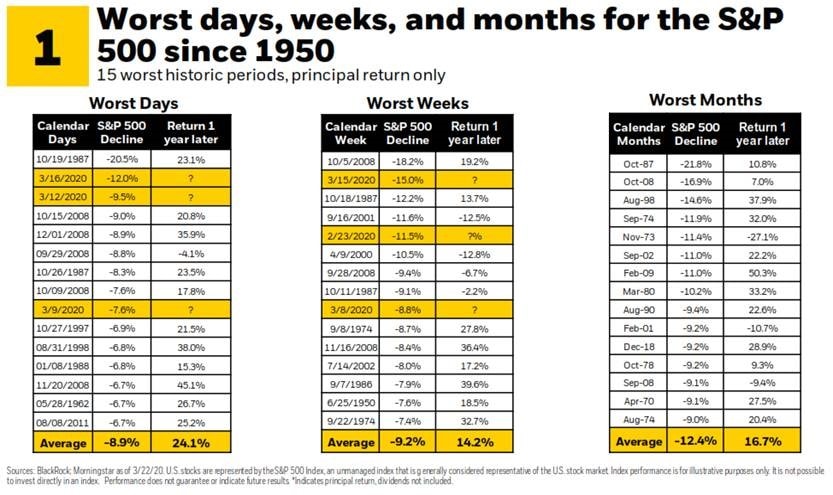

It may be tempting to reduce portfolio risk in the current environment amidst these negative headlines. However, stocks will likely begin to recover long before the pandemic is contained. We may not have experienced the bottom yet, but being there when things turn is crucial for investing. Market bottoms tend not to be made on a plethora of good news but on less awful bad news: It’s always darkest before the dawn.

We will continue to see a significant amount of volatility over the near-term as markets digest this rapidly evolving situation. However, we suggest that clients not let their emotions influence their investing decisions. We recommend maintaining a diversified allocation that is consistent with long-term goals. We remind clients to keep their next 5-8 years of income needs from their portfolio in stable assets such as cash, CDs and short-term bonds.

| Asset Index Category | Category | Category | 5-Year | 10-Year |

| 2020 YTD | 1-Year | Average | Average | |

| S&P 500 Index – Large Companies | -20.0% | -8.8% | 4.5% | 8.2% |

| S&P 400 Index – Mid-Size Companies | -30.0% | -23.9% | -1.1% | 6.2% |

| Russell 2000 Index – Small Companies | -30.9% | -25.1% | -1.6% | 5.4% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) | -22.2% | -12.9% | 2.4% | 5.7% |

| MSCI EAFE Index – Developed Intl. | -22.8% | -14.4% | -0.6% | 2.7% |

| MSCI EM Index – Emerging Markets | -23.6% | -17.7% | -0.4% | 0.7% |

| Short-Term Corporate Bonds | 1.2% | 4.9% | 2.1% | 2.1% |

| Multi-Sector Bonds | 3.1% | 8.9% | 3.3% | 3.9% |

| International Government Bonds | 1.6% | 2.1% | 2.6% | 1.3% |

| Bloomberg Commodity Index | -23.3% | -22.3% | -7.8% | -6.7% |

| Dow Jones U.S. Real Estate | -24.4% | -16.7% | 1.6% | 7.9% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.