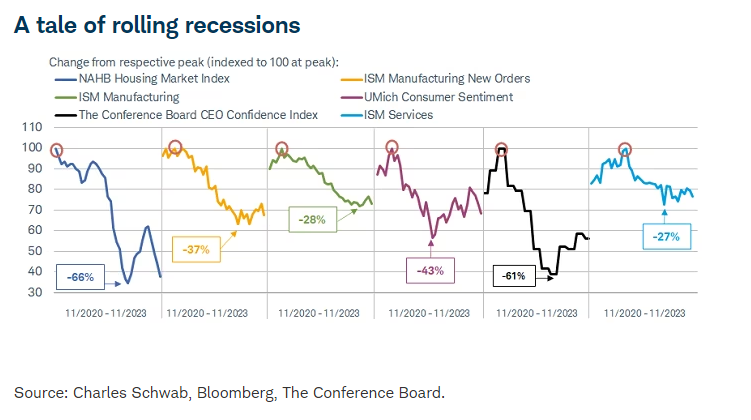

At the start of the year, it seemed like every investment strategist or economist was predicting a recession in 2023. So far, it has not happened. While we are pleased a recession has been avoided, Leading Indicators continue to point toward a weak US economy. Liz Ann Sonders, Chief Investment Strategist with Charles Schwab, says by way of explanation, “We have used the term “rolling recessions” for some time given that several key segments of the U.S. economy, including housing, manufacturing, and many consumer-oriented segments of the economy have experienced recession-level weakness.”

The weakness in some areas of the economy that would usually have investors frantic have so far been offset by strength in other areas. Then, as the weakness begins to roll over to a recovery and strength in one area, the formerly strong may begin rolling into recession-like weakness of its own.

As we digest this explanation, we start thinking of how this looks in 2024. Sonders says, “Looking ahead to 2024, we view the best-case scenario as a continued roll-through, with possible recession-level weakness in services being offset by stability and/or recovery in segments which have already taken their hits. However, we think recession risk in a traditional sense, via a formal declaration by the National Bureau of Economic Research (NBER)—the official recession arbiters since the late-1970s—is still a distinct possibility.”

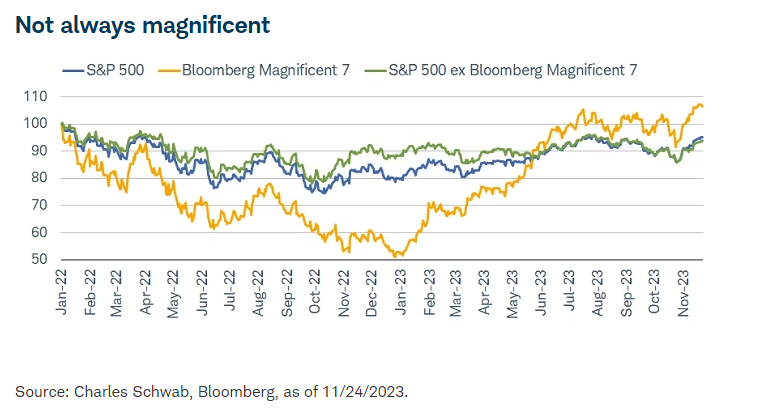

We would be remiss if we mentioned an economic and market strength without also mentioning the now dubbed Mag7: Apple, Microsoft, Alphabet (Google), Amazon, Nvidia, Meta (Facebook), and Tesla. PDS has written about this ever-popular grouping of stocks before; they’re the top 7 stocks by weight in the S&P 500 index and have helped prop up the year-to-date returns with well above average returns. Looking at the chart below, though, you may notice the strength hasn’t always been there.

True, even with the deep downturn during 2022 those 7 stocks are still better now than the rest of the index. “Without the Mag7, the S&P 500’s 2023 year-to-date gains are in the low single digits. In fact, as shown in the chart below, since the S&P 500’s prior all-time high in early January 2022, the Mag7 is up by more than 6%, but the “other 493” are actually down by nearly 6%.”

But the downturn is worth noting. It brings to mind the saying, the bigger they are the harder they fall. It has certainly benefited investors to have dollars invested in these companies – whether directly or through an index like the S&P 500 – but if we tie this back to the idea of rolling recessions it creates a good time to mention the importance and potential benefits diversification can provide.

Liz Ann Sonders agrees. “We also (always) remind investors of the benefits of diversification—both within and across asset classes—especially if, as we expect, the investing backdrop will be characterized by wider global dispersion in term of both inflation and growth patterns.”

PDS remains diligent in monitoring our client’s portfolios for opportunities like tax efficiently rebalancing allocations and tax loss harvesting. We hope everyone has a wonderful Holiday season spent with loved ones and has the chance to relax!

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.