Many investors are more than ready to turn the page on a turbulent 2022. This was a tough year where inflation soared, central banks aggressively hiked interest rates, stock markets fell and war broke out in Ukraine.

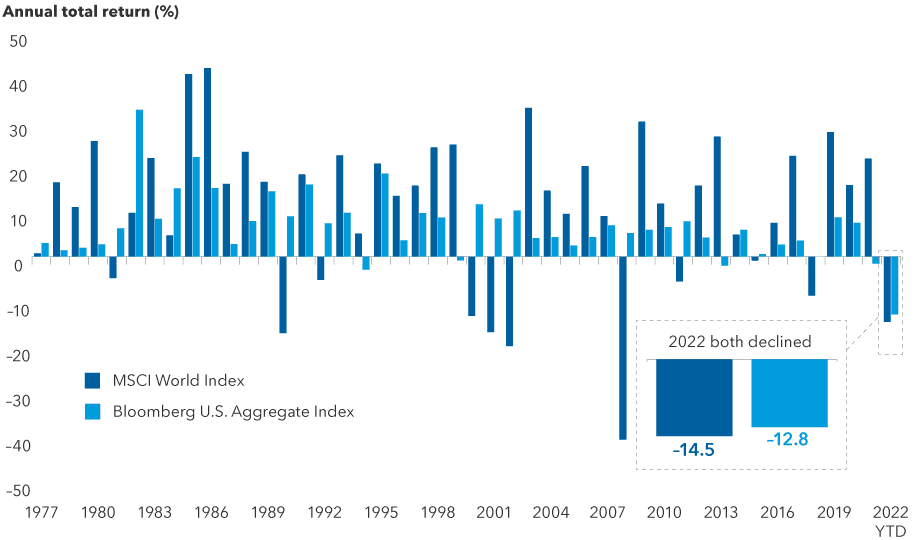

In 2022, core bonds did not fulfill their traditional role as a ballast against market volatility. In a year when global stocks slid (-14.5%), investment-grade bonds declined by a record breaking (-12.8%). According to Capital Group, “It is understandable if investors are disappointed, but outcomes like this have been rare. In fact, last year was the only time in the past 45 years that stocks and bonds fell in tandem as shown in the chart below. The conditions that led to this outcome have been rare. At a time when rates were near or below zero, the U.S. Federal Reserve and other major central banks initiated a series of aggressive hikes to tamp down inflation.” The Fed raised the federal funds rate by 425 basis points (4.25%) in the span of nine months in 2022. This was the second fastest hiking cycle since World War II.

Sources: Capital Group, Bloomberg Index Services Ltd., MSCI. Returns above reflect annual total returns in USD for all years except 2022, which reflect the year-to-date total return for both indexes. As of 11/30/2022. Past results are not predictive of results in future periods.

After such a tough year for balanced portfolios, some investors are starting to ask if they should abandon bonds altogether. We caution against this approach. One silver lining of the Fed’s aggressive tightening is that rates have risen so fast that bonds finally offer respectable yields around 4%. With these increased yields, bonds are positioned much better going into 2023 than last year.

Stocks and bonds will continue to experience volatility as markets react to inflation data, the Federal Reserve’s actions and comments, slowing global growth and recessionary concerns, but here’s to a stronger 2023!

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.