In very anti-climactic fashion, the debt ceiling was raised last week and the fears of a US default on its debt (an any impending doom to follow) were erased. The agreement suspended the borrowing limit until January 2025, so it’s possible we’ll repeat this process again in a couple short years. Michael Townsend at Charles Schwab summarizes, “The legislation reduces discretionary spending for the next two years, but those cuts do not affect defense spending—which will see an increase in the coming year—nor will there be any cuts to Social Security, Medicare, or veterans’ health care programs.” We are glad to see that, after all the political grandstanding, a compromise was reached and a default was avoided.

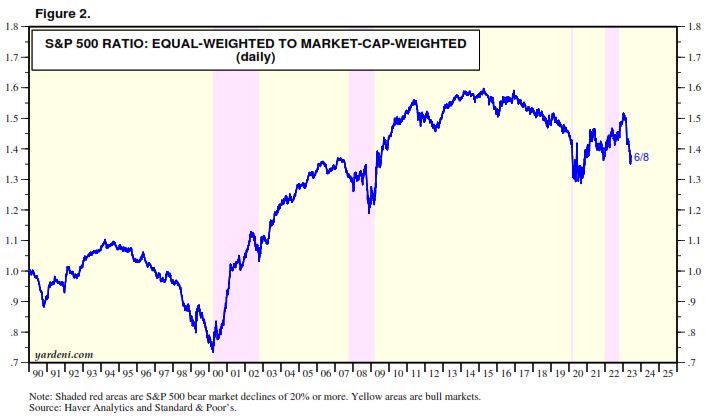

Nvidia, a tech giant, became the 7th company to reach the $1 trillion level in market cap after positive earnings and a flurry of investor interest in artificial intelligence [AI]. NVDA is the 4th largest position by weighting in the S&P 500 and has been the largest contributor to performance year-to-date, responsible for nearly 4.5%! Like I talked about in the April commentary, this isn’t necessary a good thing. The bulk of the S&P 500 returns are still coming from the top 10 holdings and the market breadth has yet to improve, as evidenced by the still falling equal weight to market cap weight S&P 500.

“Todays headlines and tomorrow’s reality are seldom the same” is a quote we use often at PDS Planning. It acts as a reminder to take a step back to avoid getting caught up in the hype and excitement within markets. Right now, it looks like AI is the next big thing. Just like Bitcoin and Cryptocurrency was the next big thing, like Marijuana stocks, like blockchain, like GameStop, and countless others. During times like these, we want to stress the importance of remaining diversified and sticking to the long-term financial plan.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.