Market concerns have escalated as the tariff policy enacted continues to evolve and change day-to-day. The situation is very fluid, and markets are just trying to keep up with the latest news coming out of the white house.

What We Know Today

We know on Tuesday, March 4th, a 25% tariff took effect on most imports from Canada and Mexico. Both countries’ leaders have been in constant communication with their US counterparts trying to minimize or remove the impact on businesses and consumers, but so far concessions have been muted this time around. Canada and Mexico are both planning to implement retaliatory tariffs of their own. An additional 10% was also levied against goods from China, who immediately responded with more tariffs of their own while also adding a number of US companies to their export-control and unreliable entity lists.

We know these tariffs will impact products like fresh veggies and produce from Mexico. Lumber and oil from Canada. Toys and clothing from China. Who pays these tariffs can get complicated. The Wall Street Journal wrote, “American businesses and other firms importing the goods will pick up the initial tab for the tariffs that Trump imposed, although who bears the ultimate burden is complicated. Businesses and importers can pass along tariff costs by raising prices for American consumers and businesses. But foreign manufacturers might also be forced to shoulder costs to keep selling to the U.S. at a competitive rate; they could even go out of business if U.S. firms shift their buying to other countries to avoid tariffs.”

We know the markets have certainly reacted towards these measures with an increased amount of volatility. And the fluidity of the situation isn’t helping. The risk of policies changing at any moment results in uncertainty, and we know markets don’t like uncertainty. In the 11 trading days since all-time highs were reached in the S&P 500 on February 19th, prices have fallen over -6.5%. Based on how things have gone so far, we wouldn’t be surprised to see the rollercoaster continue.

What We Don’t Know Tomorrow

We don’t know what markets will do tomorrow, or next week, or next month. Markets are already unpredictable, and the pace at which policies have been changing aren’t helping. We don’t know how these tariffs will impact the economy in the long run. There are plenty of economists running models and making predictions, but there are so many assumptions and inputs that we just won’t know until we know. Inflation could increase, but it could not. Jobs could be created, and manufacturing could pick up in the US, but they could not. Stocks could resume their steady climb upward, but they also could not.

What We Do Know Tomorrow

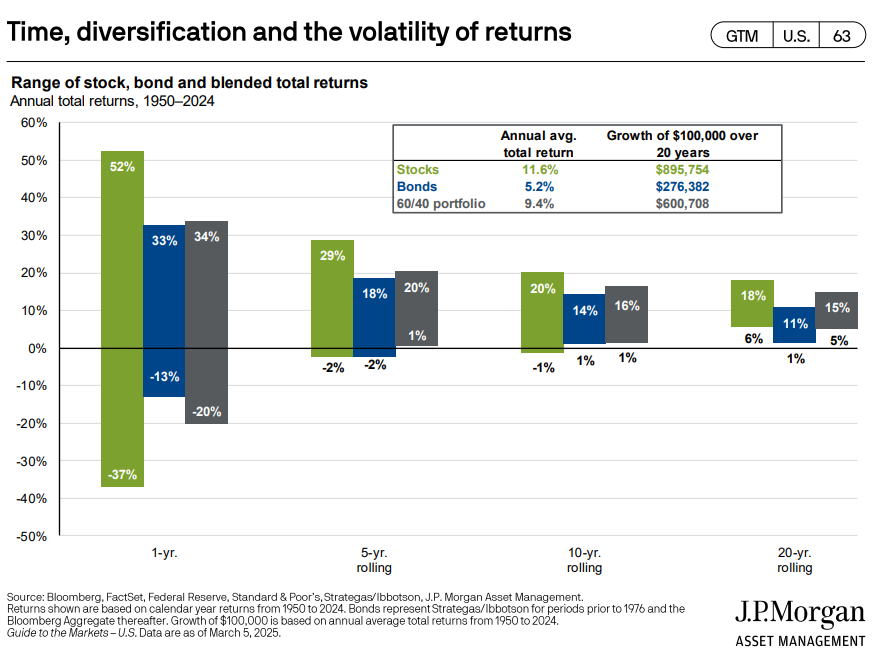

We do know that sticking to the long-term plan can work in the long run. We know that anxiety can increase, and emotions may get the better of us. But we also know that letting the emotions win and making drastic changes to the allocation is not the answer.

At PDS, we believe that developing an allocation that’s right for you based upon your specific financial plan and preferences, then maintaining the allocation through the good times and the bad. During times of extended growth or volatility, we believe timely rebalancing to maintain the target allocation and risk is necessary for long-term success, paired with tax-efficient tax loss harvesting. Trying to time the market is no match for time in the market. We are continuing to monitor markets and client portfolio’s day to day and will continue watching for rebalance and tax loss harvest opportunities.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.