Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Economic, Investment, and Other News Bits

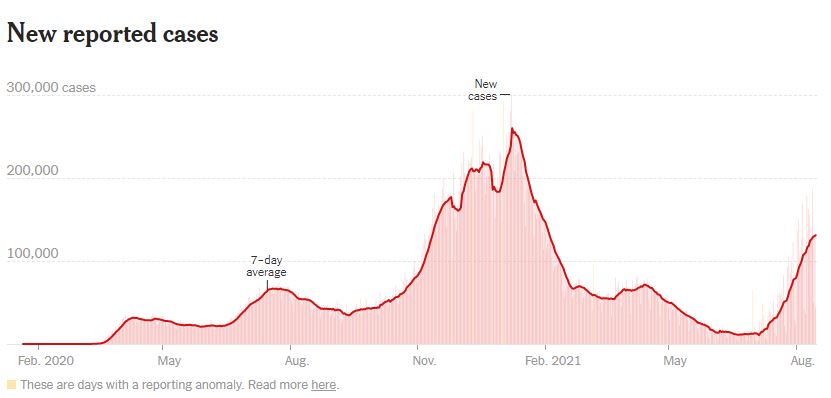

- Delta Variant: The Delta variant of the coronavirus has again been surging through the United States. We are seeing the highest rate of cases since February as an average of 124,000 cases have been confirmed daily. Hospitals in hot spots around the country are approaching capacity. (Source: New York Times)

- Columbus Company Valued at $4 Billion: Digital health startup Olive recently closed a round of funding where they received $400 million, valuing the company at $4 billion. This new net worth represents an increase of 167% in total company valuation after only 7 months. (Source: Bloomberg)

- Olympic Standouts: The 2020 Tokyo Olympics have come to a close, and even though they were without fans, they certainly weren’t without excitement.

- Allyson Felix became the most decorated American track and field athlete after winning her 10th and 11th Olympic medals – her final being a gold. (Source: ESPN)

- San Marino, a country found surrounded by Italy, won their first ever Olympic medal becoming the smallest country to do so. The cherry on top? Their 5 athletes walked away with three total medals! (Source: New York Times)

- After setting the slowest qualifying time of the finalists, Ahmed Hafnaoui of Tunisia upset the field with a stunning gold in the men’s 400m freestyle. The 18 year old won just the 5th gold medal for the country. (Source: NPR)

- 17 year old Lydia Jacoby from Alaska won the 100m butterfly, beating out reigning gold medalist Lilly King (U.S.). There is only one Olympic size swimming pool in the whole state. (Source: NBC News)

Bigger Picture: Tech in Columbus.

Ohio technology companies – many of which are in the Columbus area – broke the state’s full-year venture capital investment record with a little less than half the year remaining. If McKesson’s $1.3 billion acquisition of CoverMyMeds in 2017 wasn’t validation enough, breaking the VC record mid year goes to show Columbus has bloomed into an ideal place for future tech start-ups.

2021 has seen a whopping $1.5 billion invested throughout Ohio. In Columbus alone – staying true to its insurance and health care roots –

- $400 million was raised by Olive (see above)

- $120 million to Forge Biologics

- $100 million to Lower and AmplifyBio

- $80 million to Beam Dental

- $56 million to Path Robotics

- $50 million to both Branch Financial and Circulo.

While it’s exciting to be around so much growth and forward thinkers, the excitement from employees involved in these startups must be on another level. Venture Capital money on this level brings about many new opportunities for the company and the people involved. Often times, in the form of now extremely valuable company stock options.

These new and exciting opportunities bring with it questions about what to do next. Whether young or old, just starting a job or wrapping up a fulfilling career, PDS Planning can help answer those questions. Since 1985, PDS Planning has worked with clients to eliminate the stress often associated with planning your financial future. With over 30 years of experience helping clients plan their investments, we’re experts at optimizing an investment plan to each individual’s highly specific needs. We’ll work to understand your vision for the short and long-term. And we will provide objective guidance on the proper path to help reach your goals.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.