Welcome to our July 2023 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

NASDAQ 100 Rebalance

Earlier this week [July 24], the Nasdaq 100 performed a special rebalance; one that’s only happened twice in history. The criteria driving the rebalance was due to the adoption of the 4.5%/48% rule back in 1998. “The trigger is pulled whenever the weightings of all stocks with more than 4.5% of market capitalization individually top 48% collectively” says Liz Ann Sonders, Chief Investment Strategist with Charles Schwab. Prior to rebalancing, the collective weighting was more than 55%. The estimated new weightings would have produced a very similar year-to-date return had they started the year that way, further emphasizing the stellar returns in tech stocks in 2023.

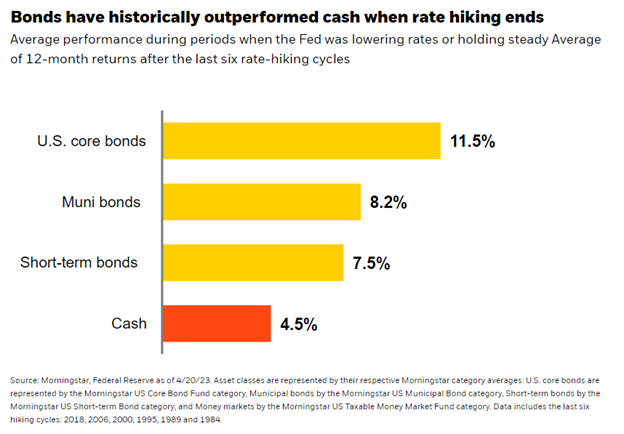

Bonds and Cash

I’ve written about cash yields earlier this year, and while they remain attractive, we feel bonds remain an important piece of the diversified portfolio allocation. Today [July 26], the Federal Open Market Committee is expected to announce a 25 basis point increase (0.25%) to interest rates. Experts anticipate this will be the last of the year based on current economic indicators. BlackRock pulled the performance data following the last 6 hiking cycles for bonds and cash and published the below chart. These numbers are average 12-month returns and, though 4.5% is nothing to ignore, paint the picture that core bonds may be a positive portfolio addition if they aren’t owned already. Now that core bond yields have ticked higher, click here for a refresher from Kurt Brown on the relationship between income returns and price returns in a bond and bond funds total return.

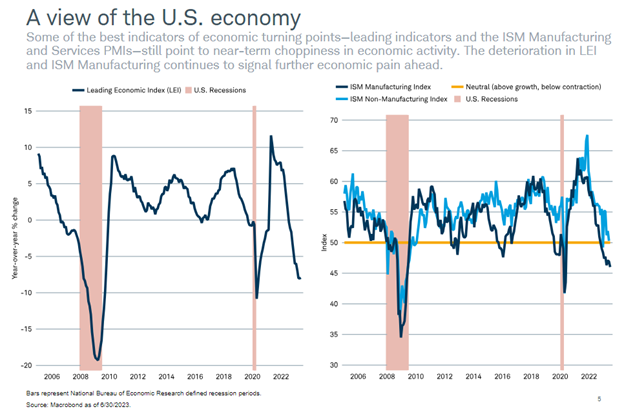

Economic Outlook Still Bleak

Looking to the most recent data, the Leading Economic Index [LEI] continues to fall year-over-year. As of the end of June, the index has fallen some 7% and is the lowest it’s been since early 2020 and before that 2009. The negative number, as shown in the chart on the left, is pointing to “near-term choppiness in economic activity” and “continues to signal further economic pain ahead.”

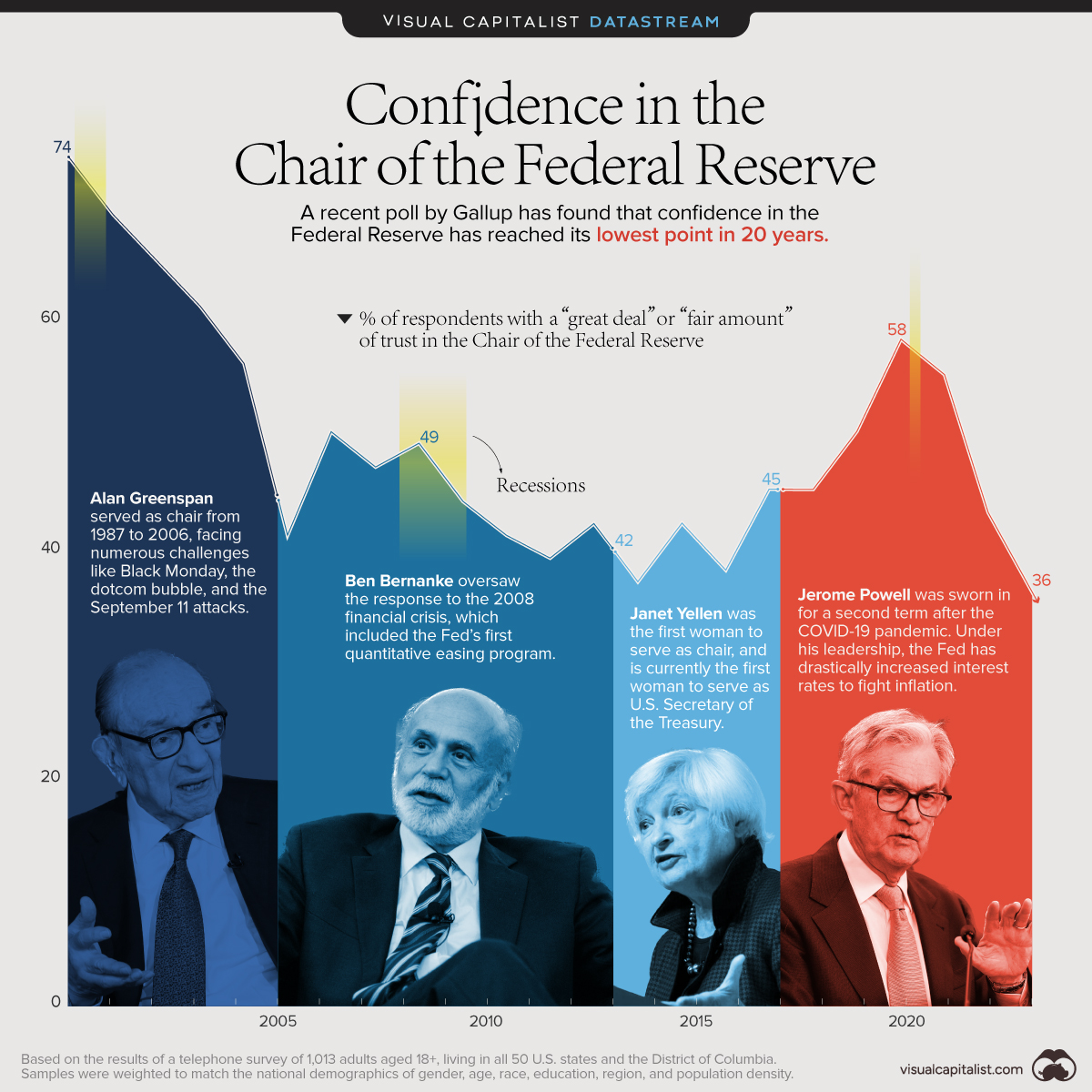

Not Trusting the Process

After being elected to a second term and consequently being tasked with managing the quick rise of inflation, the trust in Jerome Powell has dwindled to a 20 year low. Only 36% of the respondents to this Gallup poll have a ‘great deal’ or ‘fair amount’ of confidence Powell will do or recommend the right thing for the economy. Being Fed Chair requires tough decisions to be made during critical moments in time and, based on percent confidence being commonly less than 50% and thousands of different economic model iterations, it’s near impossible to make the right decision according to everyone.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.