Welcome to our November 2024 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Believe it or not, International Stocks are Keeping Up

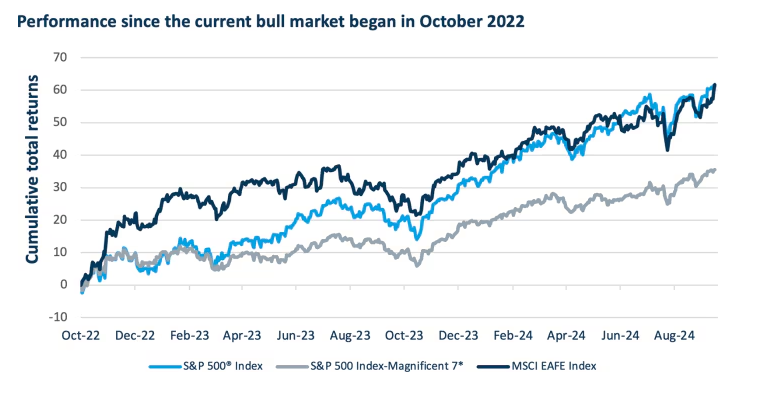

For all we talk about the Magnificent 7 and US Large cap dominance with the S&P performance, some might assume international stocks are falling far behind. It can be easy to get caught up in US stocks because of where we live and how much easier it is to see US stock information specifically. Since this current bull market began in October 2022, international stocks – defined by the MSCI EAFE Index (developed markets) – have kept up with and remain neck and neck with the performance of the S&P 500.

Bond Prices Reacting to Updated Expectations

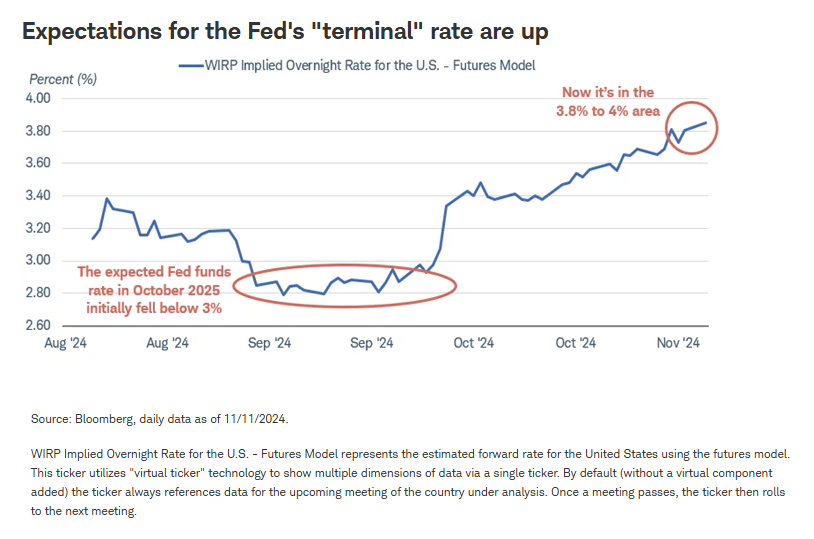

Markets are forward-looking. That’s stock and bond markets. They may react differently and in different proportions to the other, but both stocks and bonds are impacted by news and data. Economic data, particularly inflation and unemployment, have started to show strength in recent data prints. Paired with the uncertainty surrounding the potential impact tariffs will have on inflation (among other things) has resulted in the terminal rate for the Fed to increase. Rates have adjusted to the thinking rate cuts will be much slower than first anticipated and thus will remain higher for longer.

Bond prices had already been rising much of the year with anticipation of rate cuts, but now that expectations have changed those bond prices are getting realigned with the market and falling once again as yields rise.

Tariffs

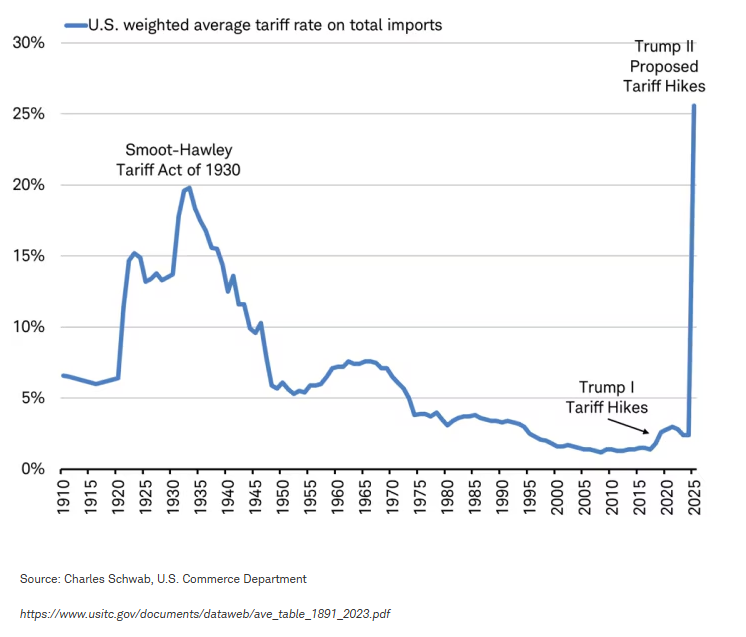

There’s been a lot to unpack regarding what might happen in the next four years and beyond since election day. Economically speaking, tariffs have been one of the major talking points. If the proposed tariff threats are enacted, “the combination of the proposed 60% China tariff and 20% across-the-board tariff would lead to an overall U.S. weighted average tariff rate of nearly 26%”, says Charles Schwab’s Jeffrey Kleintop.

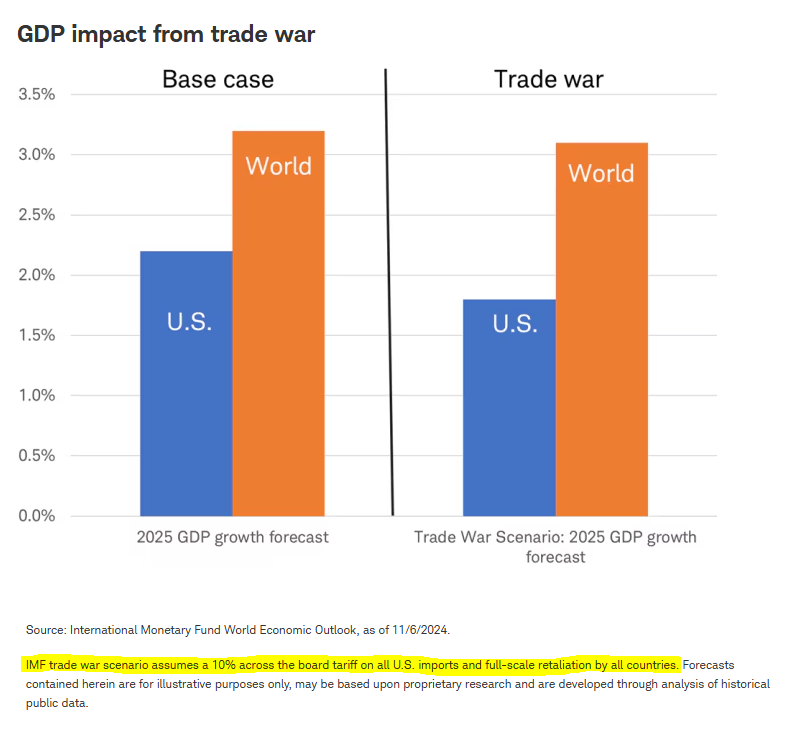

It’s generally agreed this is not the most likely scenario. There’s hope the threats will help negotiate new free trade deals with the different nations. In a full on trade war scenario the models show a minimal impact to global and US GDP. Perhaps not as bad as some thought. However, this does not take into consideration the potential impact tariffs may have on inflation (tariffs are historically inflationary) or the impact to the labor market as a result of the immigration policy. Jeffrey Kleintop then writes, “any future negative impacts could be amplified, given the proposal of much higher and broader tariffs and overall trade policy uncertainty impacting both domestic importers and multi-national businesses”.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.