Welcome to our October 2024 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

By Drew Potosky, CFP®

Posted: 10/18/2024

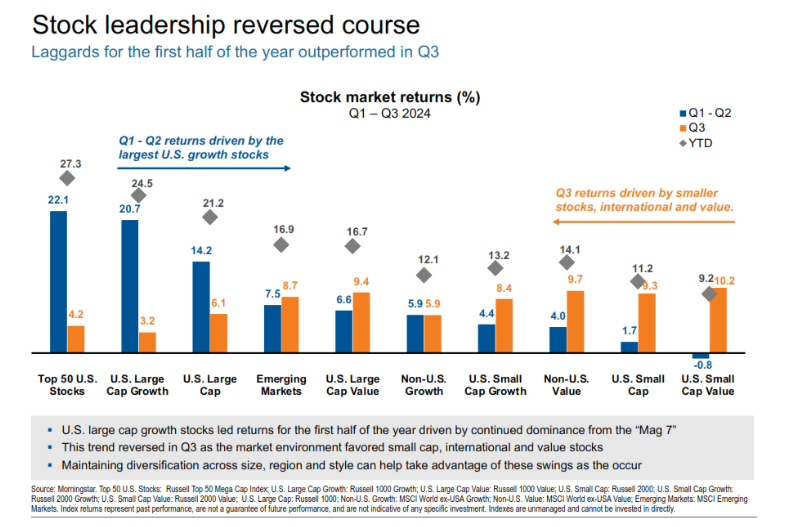

Stock Leadership Shifted in the Third Quarter

After more than a year and a half of US Large Growth propelling markets higher (thanks Mag 7), the performance leaders has finally begun to shift. The blue bars in the chart below show the category performance for the first half of the year. The orange bar shows the Q3 performance stacked up next to first half performance. The blue bars descend from left to right, showing the top 50 US stocks with the best performance during Q1 and Q2. The orange bars are near the opposite; they descend from right to left with smaller stocks and international being the big Q3 winners. “Maintaining diversification across size, region and style can help take advantage of these swings as they occur.”

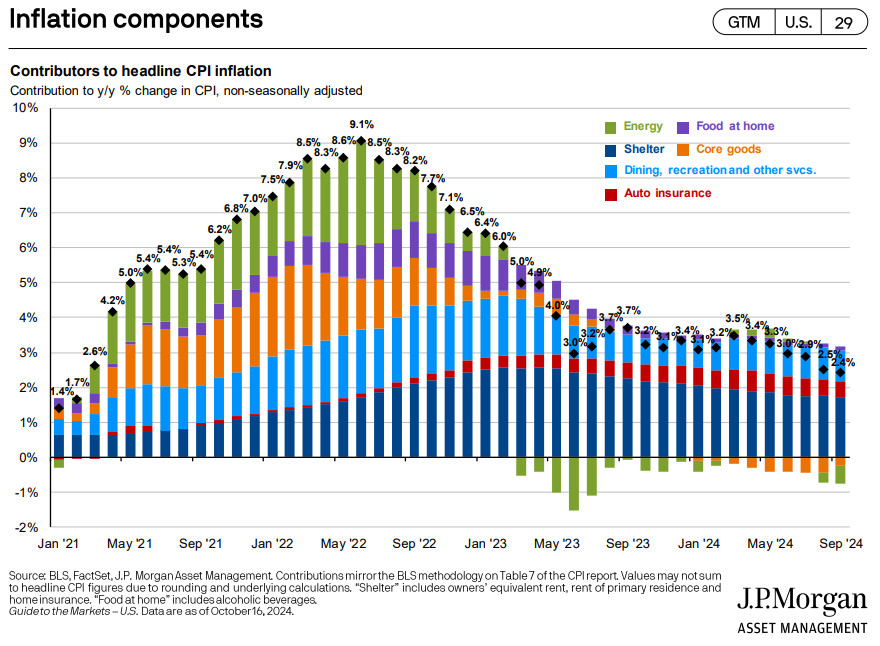

Inflation Has Continued to Trend Down

The year-over-year change to inflation has continued to come down with the last CPI reading coming in at 2.4%, now very close to the Fed’s long-term target of 2.0%. With that, the impact of monthly inflation data has had less of an impact to volatility as it did 6-12 months ago. We expect this to continue through year end. There may be renewed interest to inflation once the newly elected President takes office in 2025. Many of the policies from both parties have the potential to be inflationary and is something to keep an eye on. (guide to the markets)

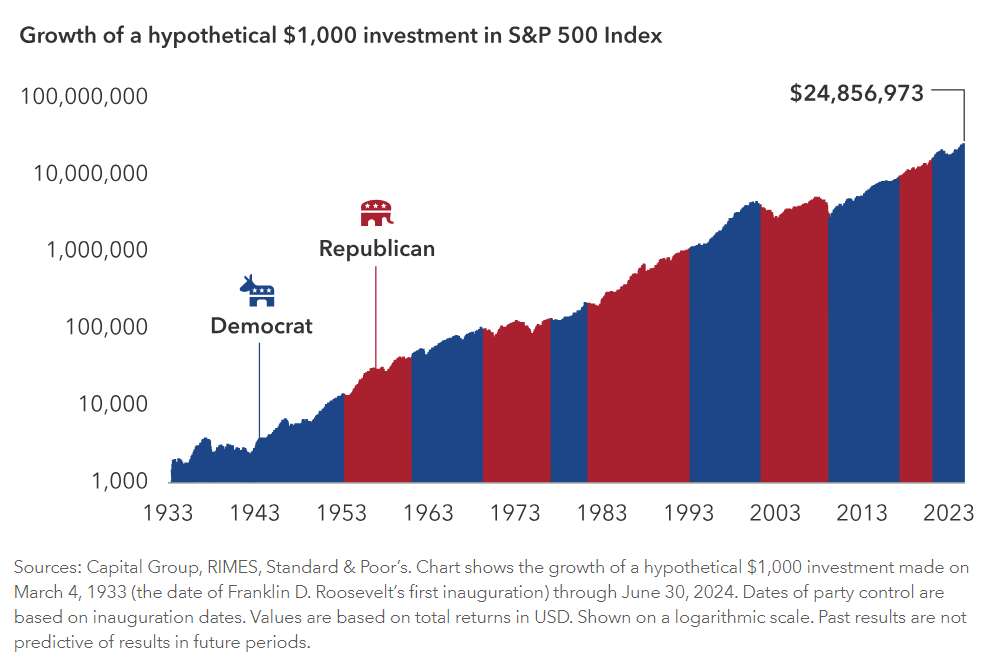

The Presidential Election and Markets…Again

The Presidential election race is coming to a head with election day only a few weeks away with no clear favorite according to polls. This significant unknown is likely to result in more stock market volatility, but that doesn’t mean any action is necessary. Regardless of who secures the win, markets really don’t care. You can see in the chart below there’s no clear “best” between red or blue. Capital Group wrote the following to accompany their chart:

“Politics can bring out strong emotions and biases, but investors would be wise to tune out the noise and focus on the long term. That’s because elections have, historically speaking, made almost no difference when it comes to long-term investment returns. Which party is in power hasn’t made a meaningful difference to stocks either. Since 1933, there have been eight Democratic and seven Republican presidents, and the general direction of the market has always been up. What should matter more to investors than election results is staying invested.”

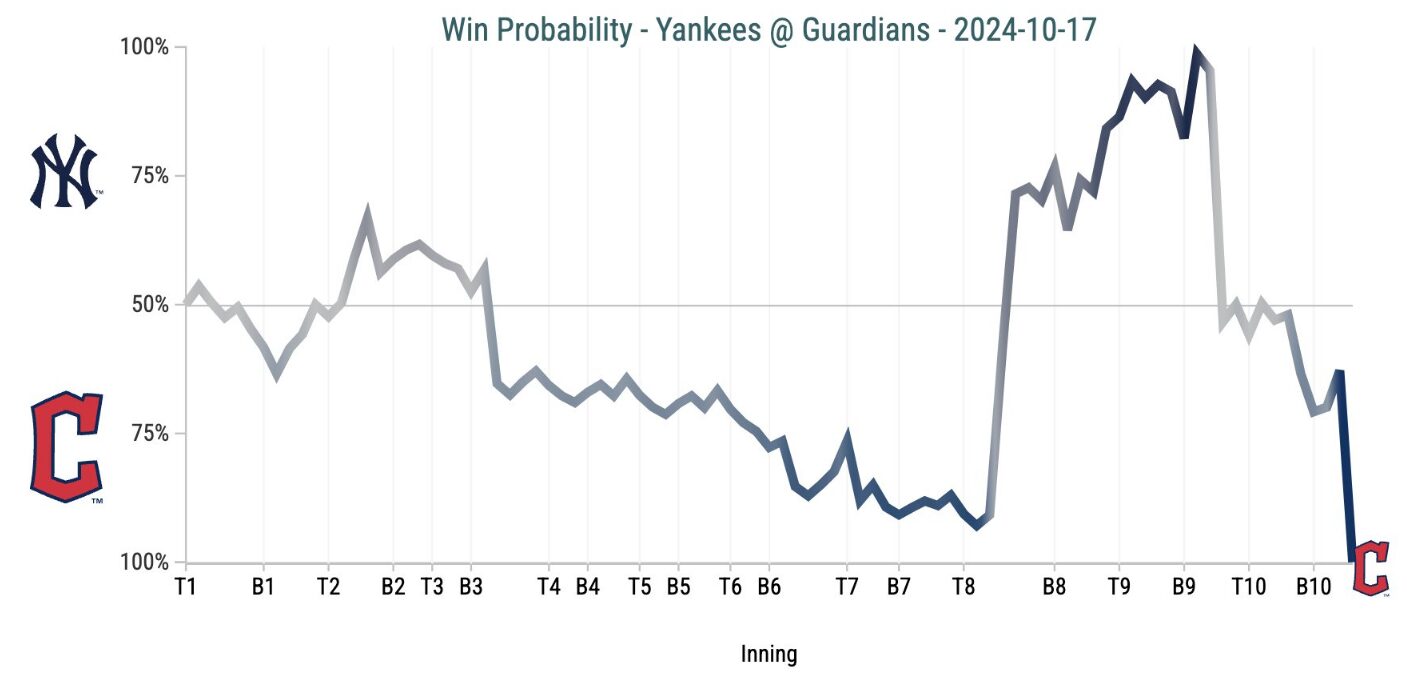

An All-Time Great Playoff Win in Guardians/Indians History?!

Last night (10/17/24), the Guardians hosted the Yankees in game 3 of a best of 7 American League Championship Series. The winner will head off to the World Series. In a game of high highs followed by the lowest of lows, the Guardians were trailing 5-3 in the bottom of the 9th, down to their last out. Watch the full Guardians comeback here. (Skip to 6:20, then 13:00 if you’re in a hurry). Below is the win probability throughout the game. What?!

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.