Volatility

The Random Walk Theory suggests that stock prices take a random and unpredictable path, therefore past trends are irrelevant to future stock price movements. We should consider renaming it the Random Sprint Theory after the volatility we’ve seen in 2020 thus far.

Recent Heightened Volatility

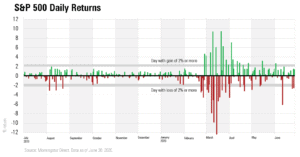

Financial markets have been moving at breakneck speeds, both up and down. You can see in the chart below the daily returns of the S&P 500 Index from June 30, 2019 through June 30,2020. The horizontal grey lines provide emphasis on daily movements of 2% or greater. The explosion in volatility is unmistakable at the end of February and continuing through March and April. Prior to the impacts of COVID-19 being priced into the market, daily market movements were relatively subdued.

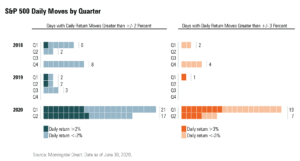

To put a finer point on the increased volatility we’ve experienced thus far in 2020, there were almost as many daily 2%+ moves in the first quarter of 2020 alone than in all of 2018 and 2019 combined. When you include the second quarter (through June 30), 2020 has had 38 daily +/- 2% moves compared to 23 days in 2018 and 2019 combined.

Recent Volatility Compared to the Great Recession

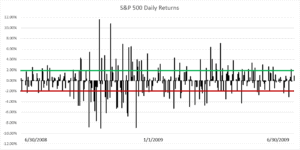

It feels like volatility has been staggering, unprecedented, even. But what if we compare recent heightened volatility to the Great Recession (2007-2009)?

Over the last year, there have been 17 days of daily returns of the S&P 500 Index greater than +/- 2%. During a particularly volatile time period of the Great Recession (June 30, 2008 – June 30, 2009), there were 47 days of daily returns greater than +/- 2%. Not only were there 2.75x more +/-2% days during the Great Recession compared to the last year, but the volatility persisted for a prolonged period of time (large bars throughout the full year). Of course, the Great Recession was followed by the longest bull market in history.

Time & Diversification

Over shorter periods of time, asset class returns can vary widely; however, long-term investors are typically rewarded for thoughtful portfolio diversification. The heightened volatility during the Great Recession was more frequent and prolonged than what we’ve experienced more recently. While we may experience continued seemingly random sprints of price volatility, rest assured the future is always the same. Maintaining a diversified allocation that is consistent with your long-term goals, combined with periodic rebalancing, has consistently resulted in beneficial long-term financial outcomes.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.