Breaking up is hard to do. The unfortunate truth is sometimes relationships just don’t work. This applies to spouses, friends, business associates – and financial advisors.

You likely entered the relationship with your financial advisor with high hopes of increasing wealth and creating financial stability. However, clients often begin to realize their own expectations and those expectations set by their advisor are not being met. Moving on may feel uncomfortable, but instead of settling, realize it is a business relationship and changing advisors is far more common than you might think, .

The fact is a good financial advisor can be a tremendous asset in helping you meet your financial goals. A financial advisor that is not a good fit for you, however, can cost you valuable time and money. It is essential to regularly assess the quality of service and advice you receive in relation to your finances.

Even when you have taken care to select the right advisor, there may come a time when it is necessary to switch. Consider the following to know when a change is needed:

Poor Communication

Your financial advisor should be able to communicate effectively and explain complex financial concepts in a way that is easy to understand. They should be attentive to your questions, goals, and concerns, providing logical answers and coherent explanations.

Periodic communication is critical. There should be a yearly review of your finances, at a minimum. Particular life or financial changes may require more frequent meetings.

Communication can be in person, over the phone, or through email. Whatever the method, communication should be clear, with ample opportunity to ask questions and receive answers that do not confuse you.

Your advisor should also make you comfortable sharing concerns or issues regarding results or plans. If you are frustrated by a lack of communication, or you consistently feel ignored, it may be time to look for a new advisor.

Unexpected Fees

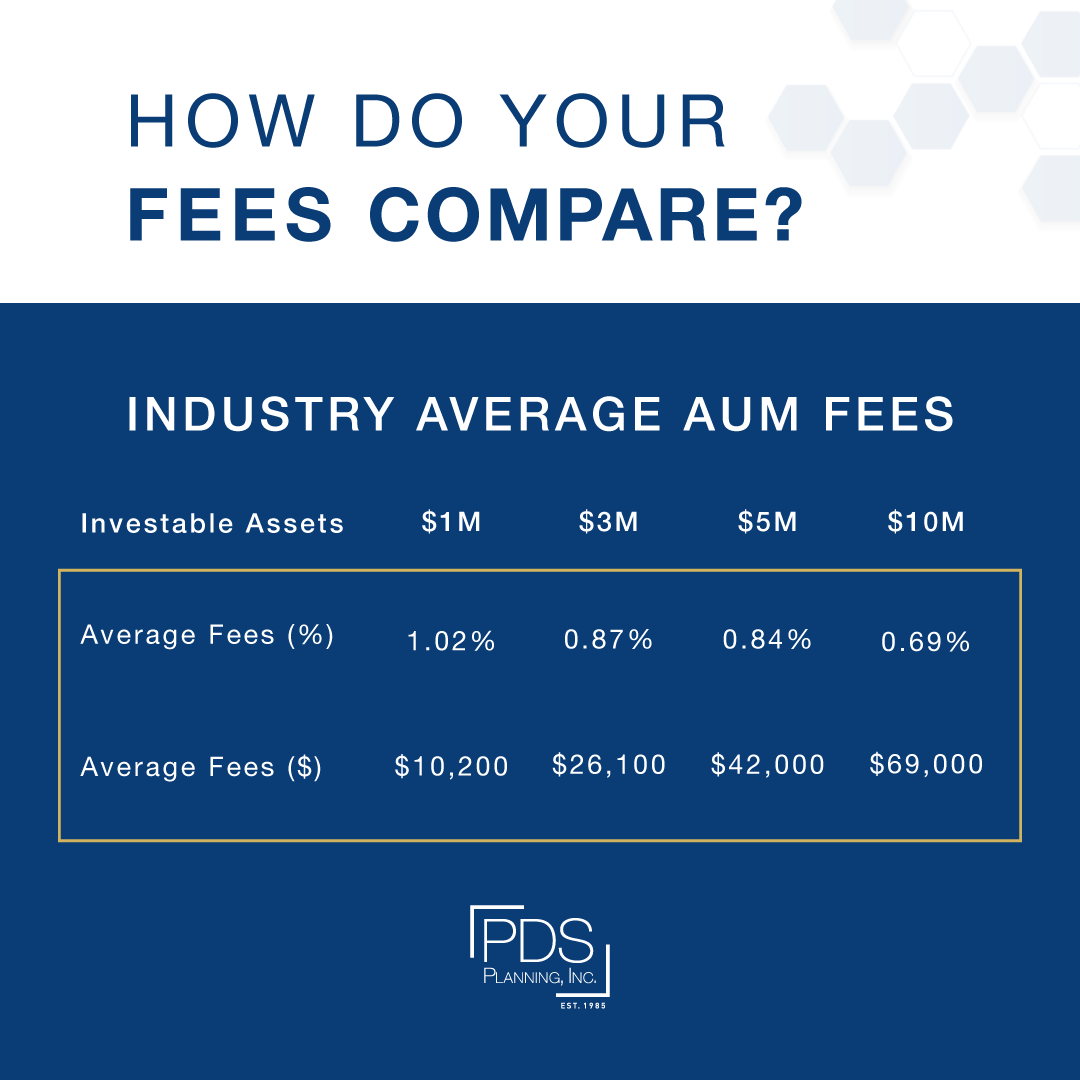

Fees are expected when working with a financial advisor. You may pay annual recurring management fees expressed as an annual percentage, such as 1%, of the assets you own. Or you may work with an advisor who earns their fees through commissions by selling you financial products, such as annuities. Regardless, you must figure out how your advisor is compensated and how much you are paying in dollars, not percentages. At PDS Planning, we have a straightforward flat, fee-only structure, charging for the time and resources necessary to do the planning and financial work required.

Review your fee structure regularly to avoid being surprised by additional costs. If you feel you are being overcharged, taken advantage of or simply not receiving the value you expect, it is best to move on and find an advisor who charges a transparent and easy-to-understand fee that aligns with your goals and and best interests.

Incompatible Philosophies

When you build a relationship with your financial advisor, they become familiar – or should – with your risk profile and the type of investments to steer your portfolio in the right direction to meet your long-term objectives. Your relationship should be dynamic, with room for changing life circumstances.

For example, significant life changes like retiring or having kids can affect your risk tolerance and overall financial goals. Your advisor should adjust accordingly.

Check in with your financial advisor’s investment philosophy. Does it correspond with what you currently want? If not, it may be time to move on.

Discouraging Results

When you began working with your financial advisor, you established a plan based on your goals. Your financial advisor should monitor your progress and update you on whether you are on track to reach your goals. Investment returns can be affected by numerous factors. Your financial advisor should review these situations and provide innovative solutions if things are not going well.

How do I switch financial advisors?

After reviewing your situation, you may decide it is time to make a change. If you’re ready to find a new financial advisor, the following steps can help avoid surprises.

1. Review Your Agreement

You most likely signed an agreement when you began working with your current financial advisor. Read through your terms to understand how to move forward. Your agreement should include how long your agreement period will last, how to transfer accounts, and how to give notice to move on from the relationship formally.

2. Record Your Transaction History

Transferring your accounts to another financial advisor will also transfer your prior transaction history. However, you should log in and download the current information for your record as a backup. Having this information on hand is vital when interviewing potential new financial advisors.

3. Find a New Advisor

This process can and should take as much time as you need. Take your time identifying the right person who offers the right products and/or services. Take the lessons you learned from your previous experience so you don’t repeat this process.

4. Consult Your New Advisor

Have your new advisor review your account statements and identify anything that may be proprietary to your old firm. These will need to be sold first and then transferred as cash. Be sure to identify any costs you’ll incur in this process.

5. Inform Your Old Advisor

While reviewing your assets and determining which ones are transferable, inform your financial advisor you are transferring to a new firm. If you find the conversation too uncomfortable, you can inquire about the transfer as fact-finding and allow your new advisor to complete the process. Once permitted, your new advisor will initiate the transfer.

Making a break from any relationship can feel daunting, but staying in a relationship that no longer aligns with your goals and expectations can be far more damaging to your long-term financial success

At PDS, we believe financial advice is more than numbers and spreadsheets—it’s about a personalized plan to help you navigate the choices ahead as we help you build the life and legacy you want. Our approach revolves around your goals and how we can help you accomplish your vision for the future. Whether you are considering a switch from your current financial advisor, getting a second opinion or are interested in just getting started, we are here to help. Contact us today to learn more.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.